44 what is coupon for bond

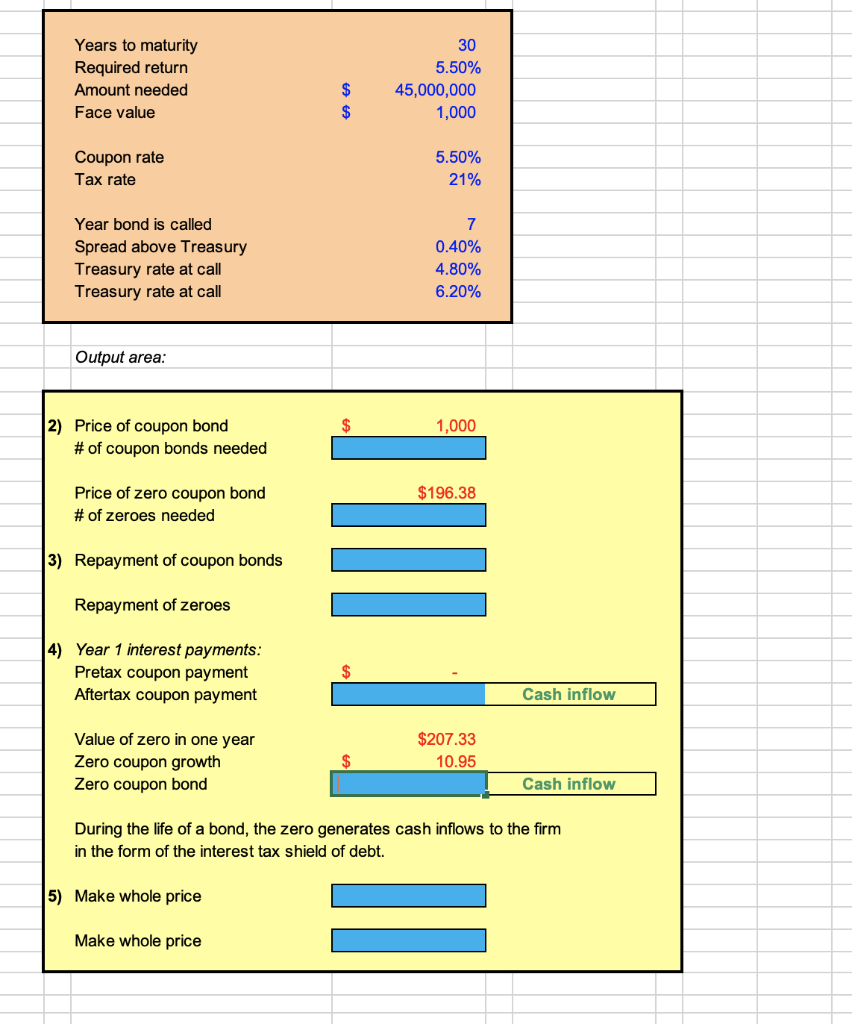

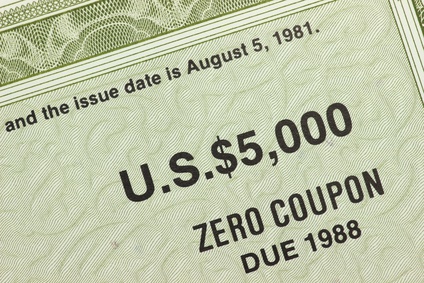

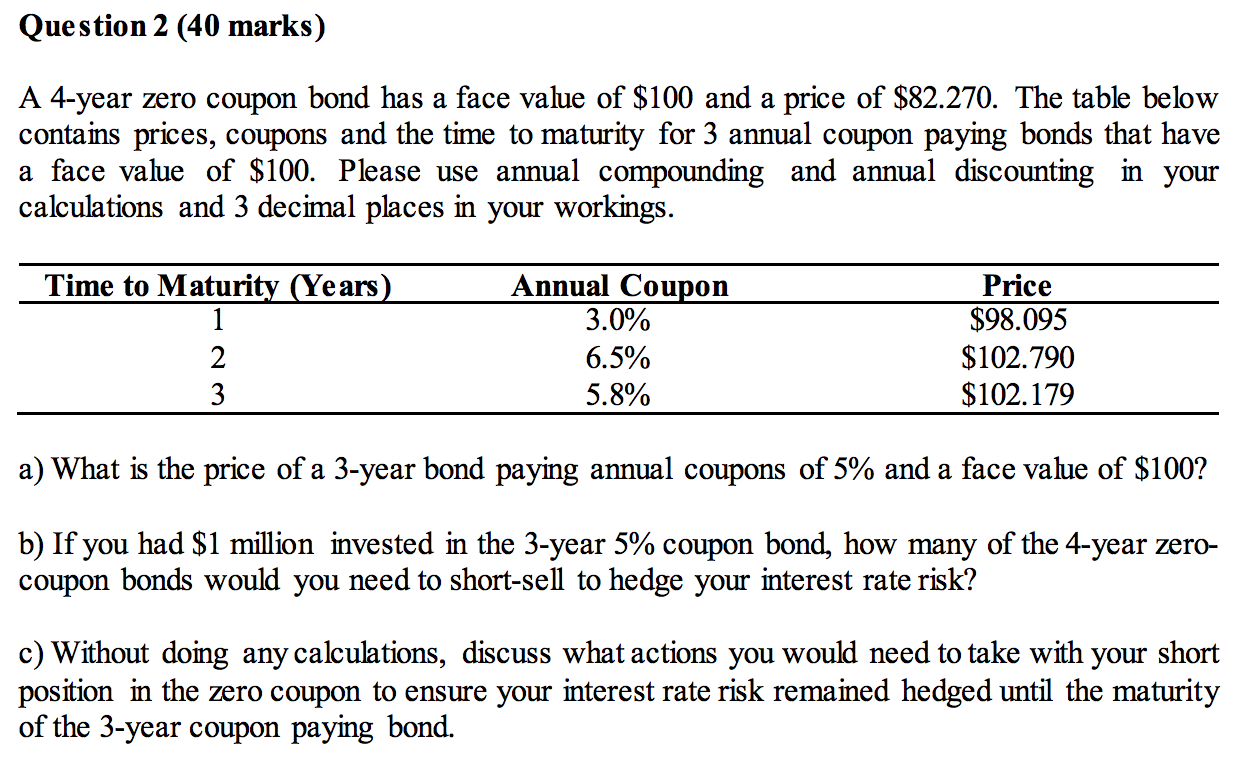

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep A Zero-Coupon Bond is priced at a discount to its face (par) value with no periodic interest payments from the date of issuance until maturity. Zero-Coupon Bond Features How Do Zero Coupon Bonds Work? Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. Coupon Bond | Definition | Rates | Benefits & Risks | How It Works A coupon bond is an investment that pays a regular interest payment to the holder of the security. The issuer guarantees that it will pay this amount as long as they hold on to the coupon bond. The issuer is also obligated to repay the whole of the bond's face value on its maturity date. Coupon bonds are typically paid twice per year by ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.

What is coupon for bond

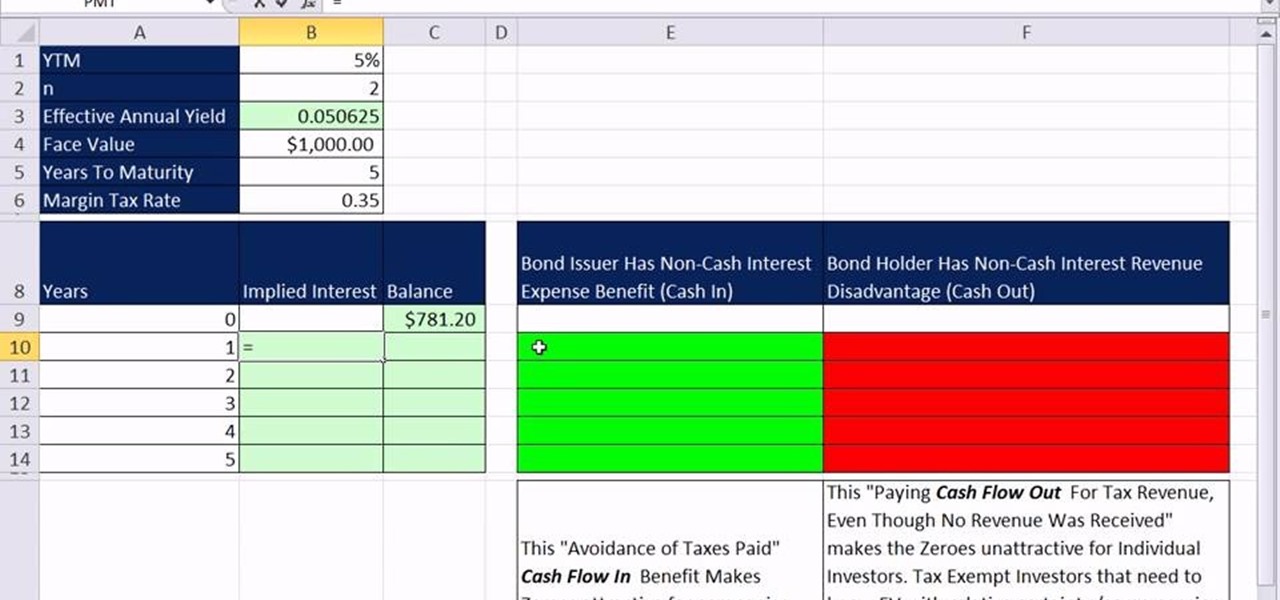

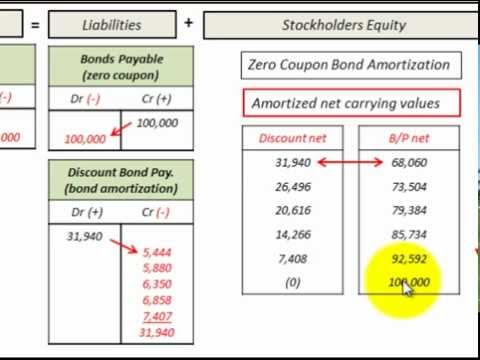

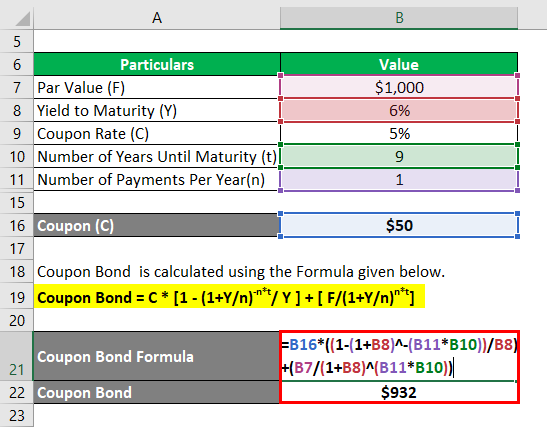

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [(1-(1+7%/2))^(-12)) / (7%/2) ] + [$1,000/(1+7%/2)^12] Coupon Bond = $951.68. Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price. The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Please understand that a bond is ... Coupon Types - Financial Edge There is a special type of fixed-rate bond called a zero-coupon bond. In this case, there is no interest payment between the issuance of the bond and maturity. So, they "pay" a fixed coupon of 0%. This does not mean that there is no return for bondholders, as zero-coupon bonds are usually sold at a discounted price but repaid at 100% at ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as the name suggests, zero-coupon bonds...

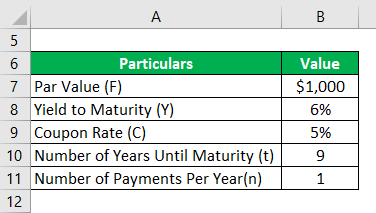

What is coupon for bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. › terms › bBond Discount - Investopedia May 29, 2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

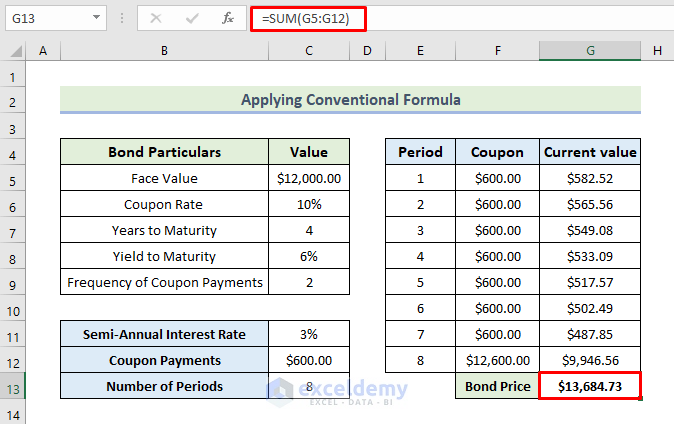

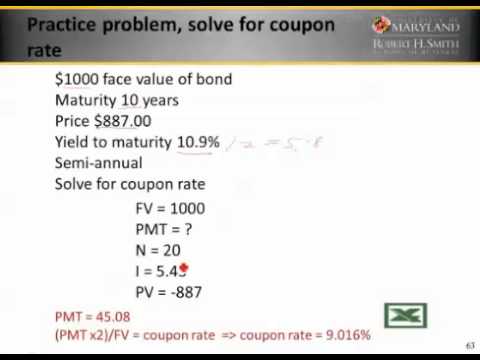

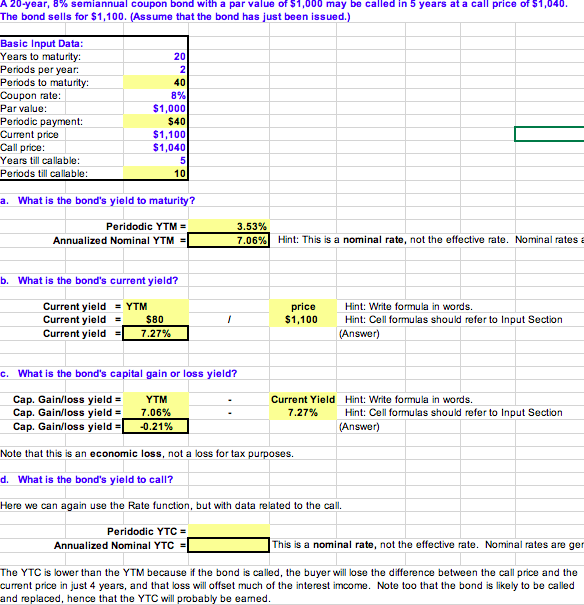

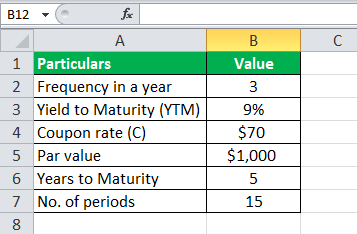

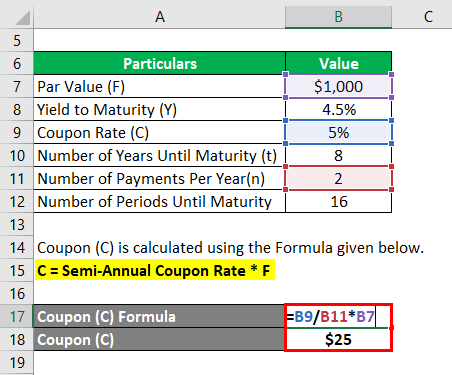

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ... › finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

What Is A Bond, How To Calculate Bonds Return, And More If you invest $10,000 in government bonds and interest rates lower, you can sell them for more than $10,000. Corporate bonds — Corporate bonds are riskier than government bonds since they are backed by the assets of the company issuing the bond. How To Calculate The Return On A Bond. When you invest in a bond, there are five metrics to review:

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

What Are Corporate Bonds and How Do They Work? What Is a Corporate Bond? In a nutshell, a corporate bond is like a loan from an investor to a company, which the company repays with interest by the bond's

Coupon Rate Calculator | Bond Coupon A coupon is the interest payment of a bond. Typically, it is distributed annually or semi-annually depending on the bond. We usually calculate it as the product of the coupon rate and the face value of the bond. How often do I receive coupons from investing in bonds? The short answer is it depends on the bonds that you invest in.

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

How do you calculate the coupon rate of a bond? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. How does interest rate affect coupon rate? If a coupon is higher than the prevailing interest rate, the bond's price rises; if the coupon is lower, the bond's price falls. The majority of bonds boast fixed coupon rates that ...

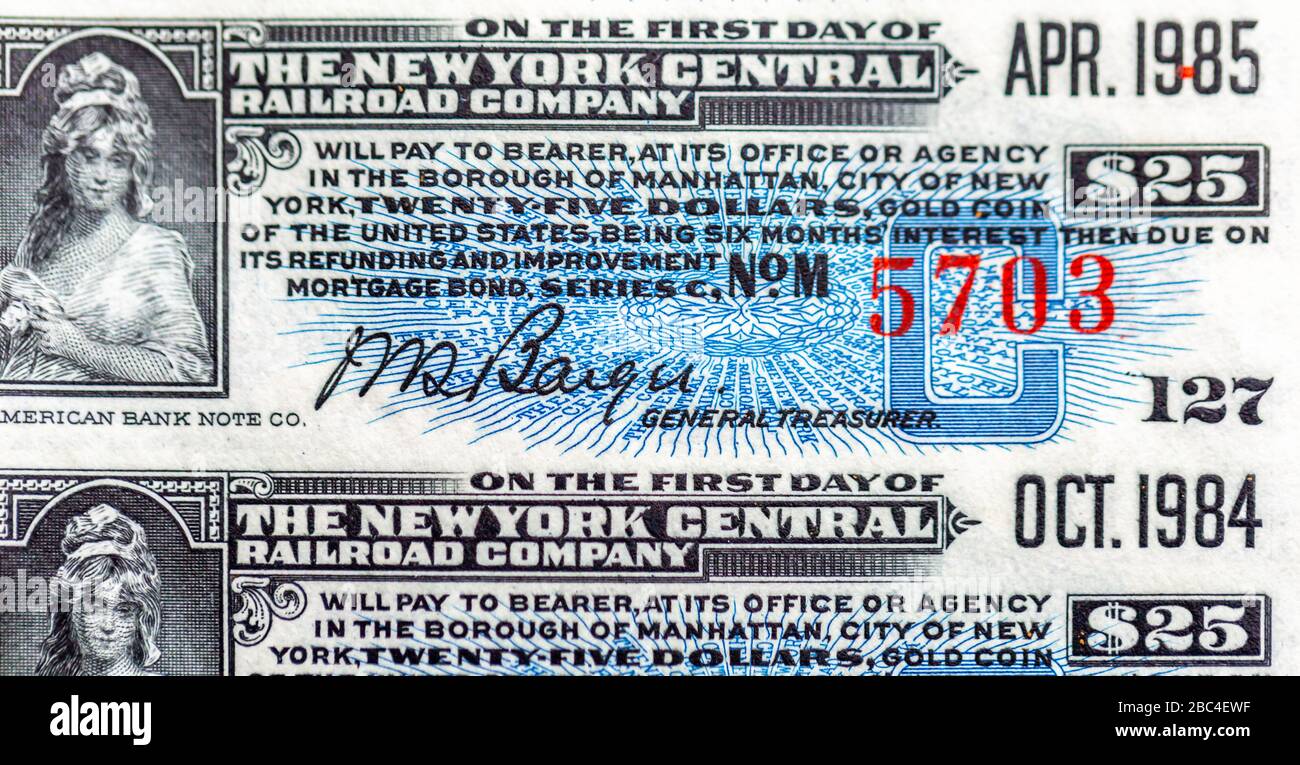

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as the name suggests, zero-coupon bonds...

Coupon Types - Financial Edge There is a special type of fixed-rate bond called a zero-coupon bond. In this case, there is no interest payment between the issuance of the bond and maturity. So, they "pay" a fixed coupon of 0%. This does not mean that there is no return for bondholders, as zero-coupon bonds are usually sold at a discounted price but repaid at 100% at ...

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [(1-(1+7%/2))^(-12)) / (7%/2) ] + [$1,000/(1+7%/2)^12] Coupon Bond = $951.68. Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price. The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Please understand that a bond is ...

Post a Comment for "44 what is coupon for bond"